Download Entire report

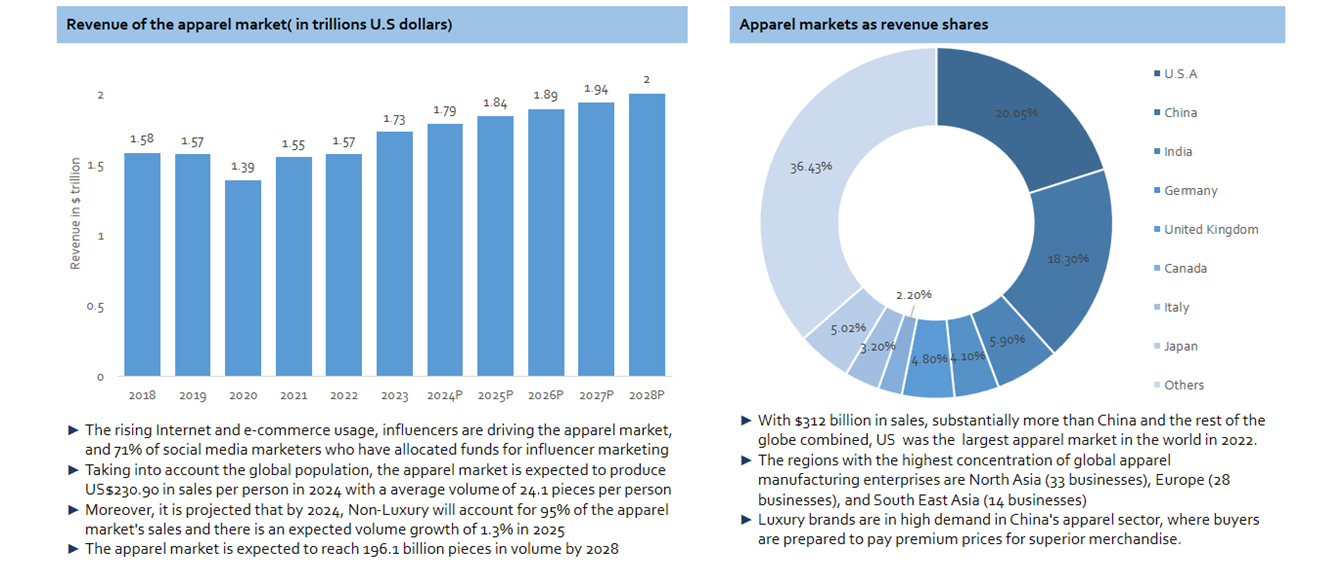

Pay $4.99The global apparel market size is expected to reach at $1.79 trillion in 2024 and the market is projected to grow at a CAGR of 2.81% between 2024 and 2028, reaching at $2 trillion.

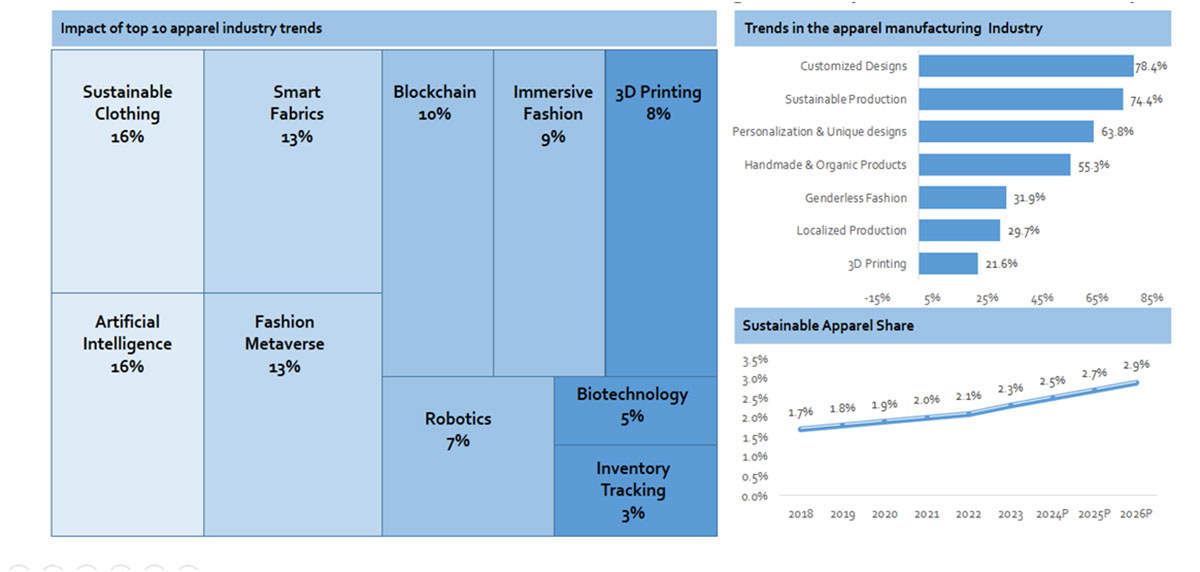

The demand for apparel items is driven by fashion-conscious consumers who are always on the lookout for new styles, patterns, and trends like athleisure, customization, and sustainability are some of the trends that shape the market.

The demand for garment items has increased as a result of rising apparel consumption in emerging nations due to growing disposable incomes

Consumer habits have changed as a result of urbanization, placing more value on fashion & beauty; emerging markets with middle class growth have seen growth

Demand for sportswear, athleisure, and performance-oriented clothing has increased due to the increased emphasis on health and fitness. Consumers are looking for trendy yet comfortable clothing that fits their lifestyles.

Growing disposable incomes and shifting consumer habits present significant growth prospects in emerging economies like China, India, and Brazil & Southeast Asia

The increasing demand from consumers for clothing that is environmentally & ethically made offers apparel firms a great chance to adopt sustainable practices

By using technologies like 3D printing, customization software, and made-to-measure services, brands may set themselves apart from competitors by providing distinctive and customized experiences to increase customer loyalty

The emergence of digital-native businesses and e-commerce platforms is upending conventional retail patterns and increasing competitiveness in the clothing sector

Trade restrictions, tariffs, and geopolitical unrest can affect market access in important areas, break supply chains, and raise production costs.

Technologies like automation, AI, and data analytics necessitate retraining and upskilling of workers in the garment sector & bridging the gap to foster digital literacy, and fostering a culture of innovation has become essential for companies

1. Industry Overview

2. Industry Market Size

3. Market Insights

4. Consumer Insights

5. Pricing Insights

6. Cost Insights

7. Business Models

8. Industry Trends

9. Market Drivers and Restraints

10. Market Opportunities and Challenges

11. Competitive Benchmarking

12. Company Analysis(1/4)

13. Company Analysis(2/4)

14. Company Analysis(3/4)

15. Company Analysis(4/4)

16. Regional Insights- India

17. Regional Insights- USA

18. SWOT Analysis

19. Porter Five Forces Analysis

20. Company Segmentation

Download Entire report

Pay $4.99Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.

Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.

Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.