Download Entire report

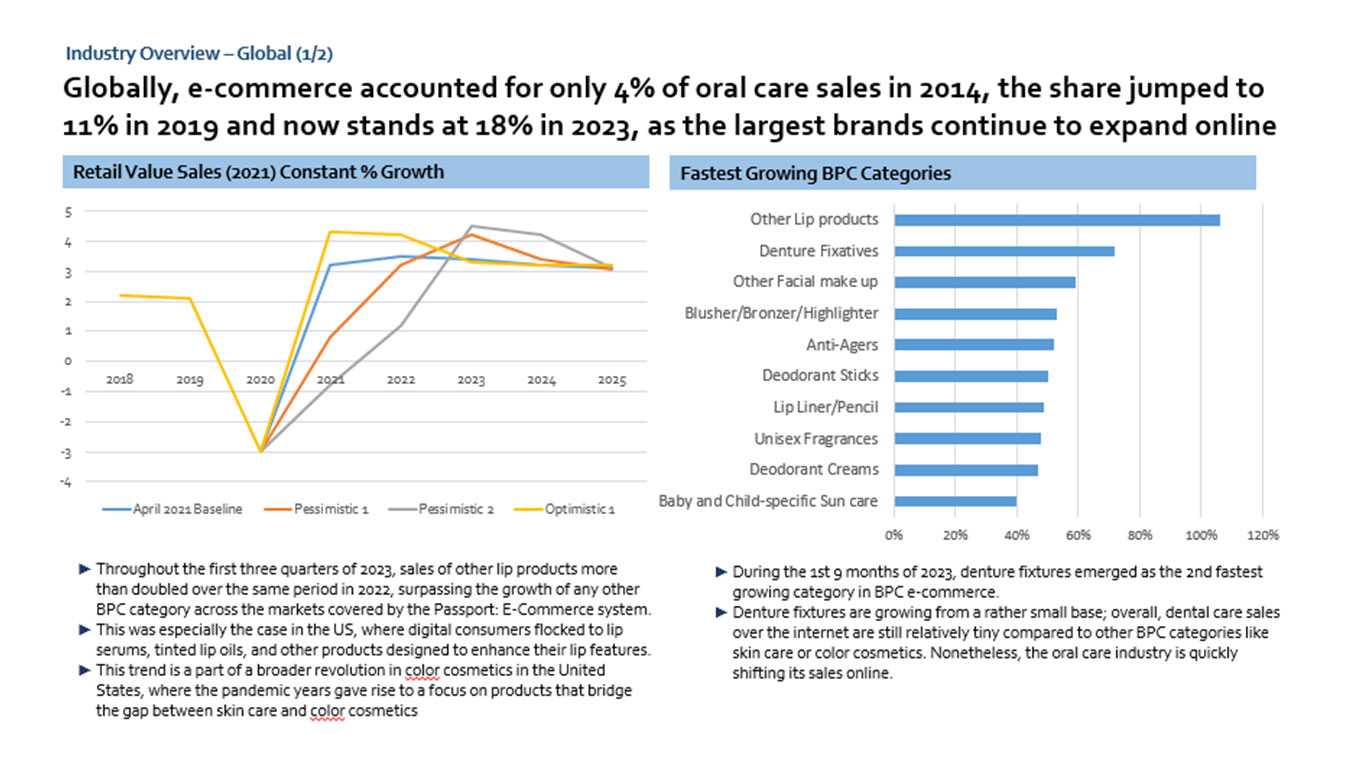

Pay $4.99Globally, e-commerce accounted for only 4% of oral care sales in 2014, the share jumped to 11% in 2019 and now stands at 18% in 2023, as the largest brands continue to expand online.

The global Beauty and Personal Care (BPC) market is projected to be sized at US$ 660 Bn+ with $2.2-2.7 Tn market cap. by 2027

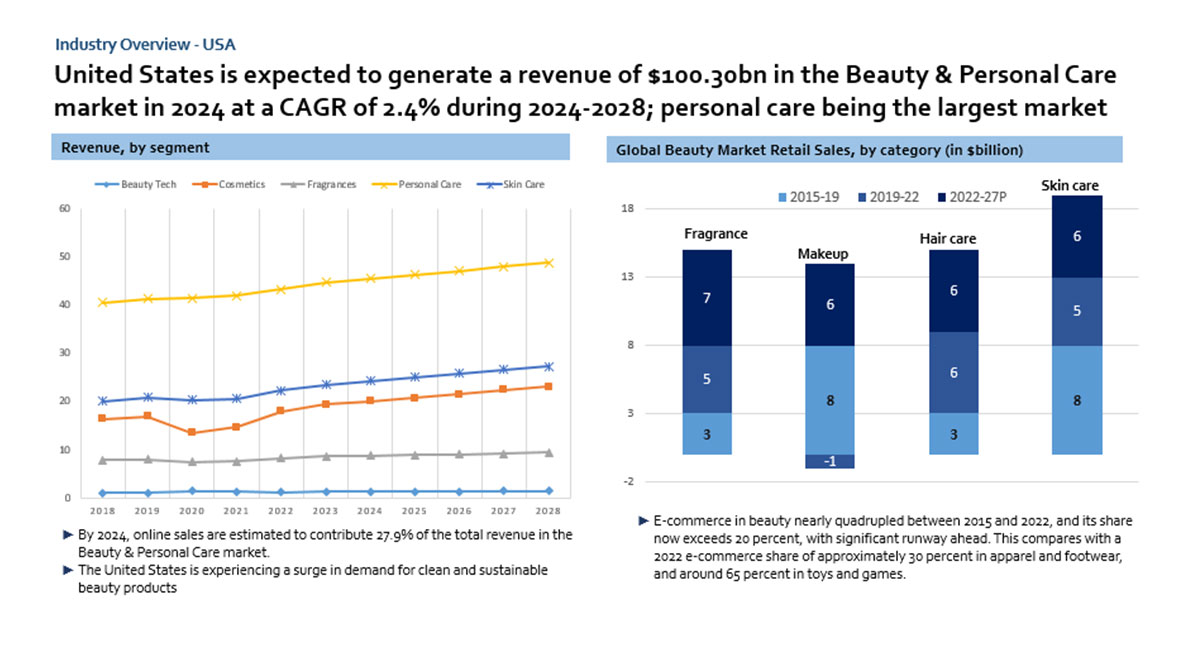

United States is expected to generate a revenue of $100.30bn in the Beauty & Personal Care market in 2024 at a CAGR of 2.4% during 2024-2028; personal care being the largest market

1. Industry Overview

2. Executive Summary

3. Industry Overview – Global (1/2)

4. Industry Overview – Global (2/2)

5. Industry Overview - USA

6. Consumer Behaviour

7. Primary BPC Models

8. The specialized and effective products results in higher pricing power

9. Pure-play companies are spending more money across a variety of platforms in an effort to reach customers where they are

10. They have superior online engagement and brand salience, resulting in higher online revenue contribution

11. Leads to better valuations

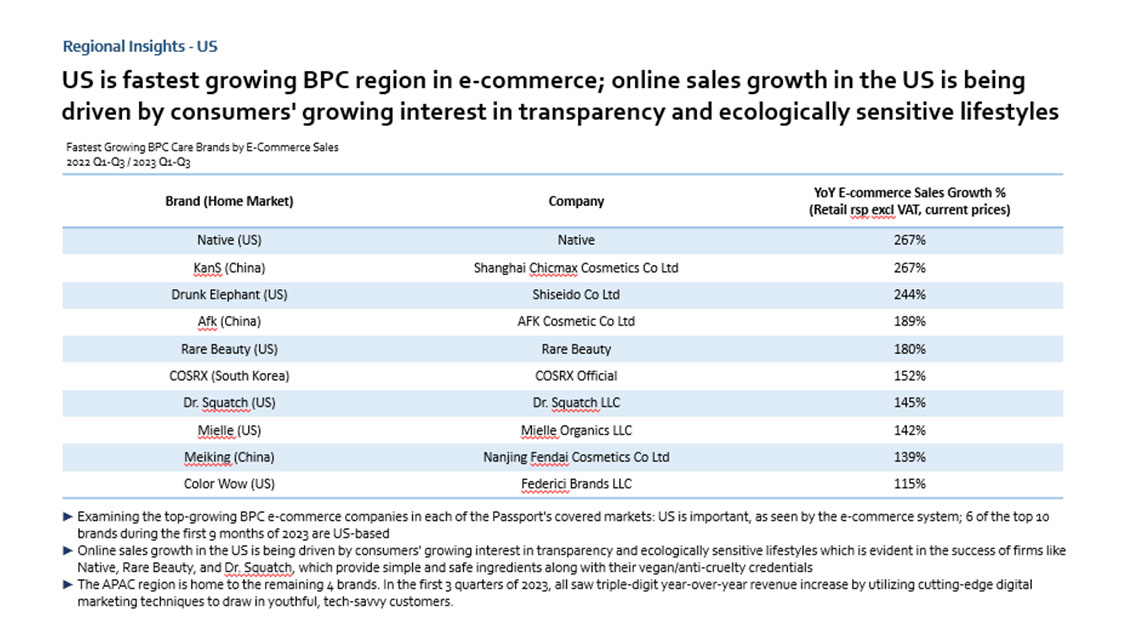

12. Regional Insights - US

13. Regional Insights - India

14. India is the fastest growing BPC market among the large economies

15. In line with global trends, Indian pure-play BPC brands are disrupting the market, growing 2x+ as fast as the FMCG-led players

16. Competitor Analysis (1/2) – Nykaa and Honasa (Parent Company of ‘Mamaearth’)

17. Competitor Analysis (1/2) – Loreal, Nykaa and Honasa

18. Multiple brands & products with low differentiation along with lack of proper guidance are some of the key pain points

19. Customer Segmentation

20. Consumer Behaviour (1/2)

21. Consumer Behaviour (2/2)

22. Distribution Channel

Download Entire report

Pay $4.99Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.

Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.

Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.