Download Entire report

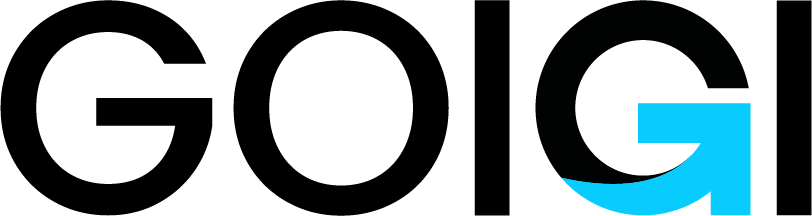

Pay $4.99The packers and movers industry is expected to expand at a CAGR of 2% between 2020 & 2024, or by $1.95 billion because of the disruption caused by the pandemic in 2020 and 2021

Using technology to increase productivity is something that the packers and movers sector is seeing more and more of. Specialized software and other technical tools are being used by businesses to improve efficiency and streamline processes.

Another trend becoming more and more popular in the market is using environmentally friendly packaging options. People are increasingly searching for eco-friendly solutions to relocate their possessions as environmental consciousness grows.

Utilizing creative marketing techniques is the final trend that is revolutionizing the packers and movers sector. These days, businesses use a variety of tactics to connect with their target market and build brand awareness. This entails advertising their services on social media sites like Facebook and Twitter in addition to employing SEO.

ESG - Sustainability is now one of the packaging design's most potent forces, outweighing both cost and performance in some applications thus establishing high growth areas.

AI Assistants - Virtual assistants may sort through consumer inquiries, offer prompt assistance, and even help with moving arrangements. They can offer instant customer support, which streamlines and responds to the process.

Mobile Apps - Customers can communicate with movers, get real-time shipment status, and even make payments using mobile apps. Customers will find this more convenient, while moving companies will gain from stronger client involvement

Rising Fuel Costs - For every moving company, fuel is a big expense. Variations in fuel prices may exert pressure on your margins of profit.

Intense Competition - The moving and packing business is very cutthroat; differentiation can only be done by providing great customer service, specializing in a certain market, or delivering services.

Seasonal Variations - There might be seasonal variations in the demand for moving services, with summertime peaks and wintertime fades.

1. Industry Global Market

2. Global Trends in the Industry

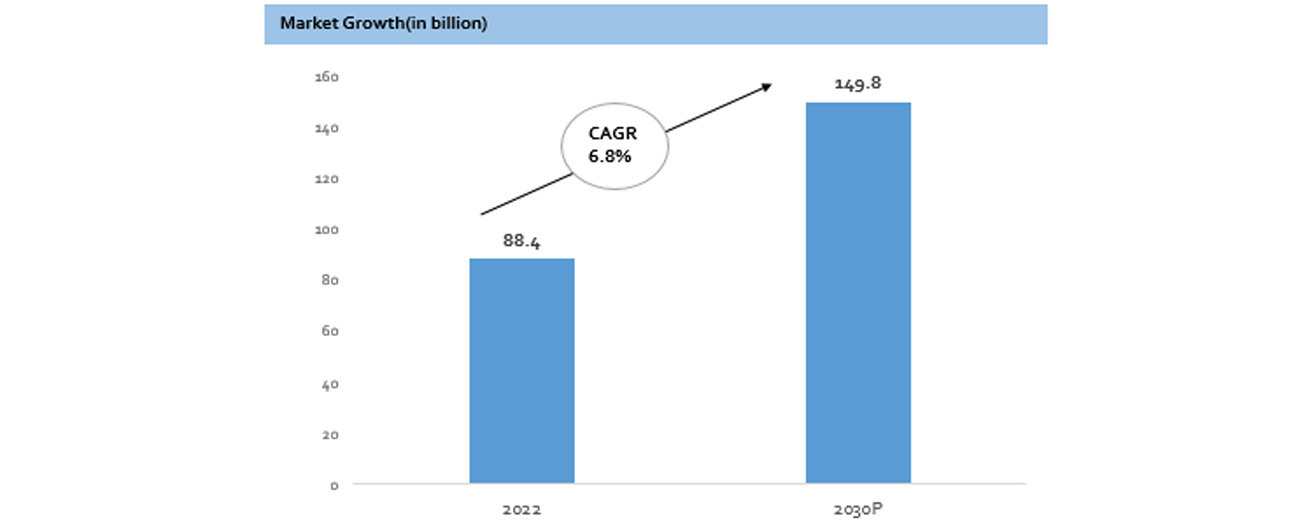

3. Business Models in the Industry(1/2)

4. Business Models in the Industry(2/2)

5. Global Opportunities and Challenges

6. Pricing Strategy

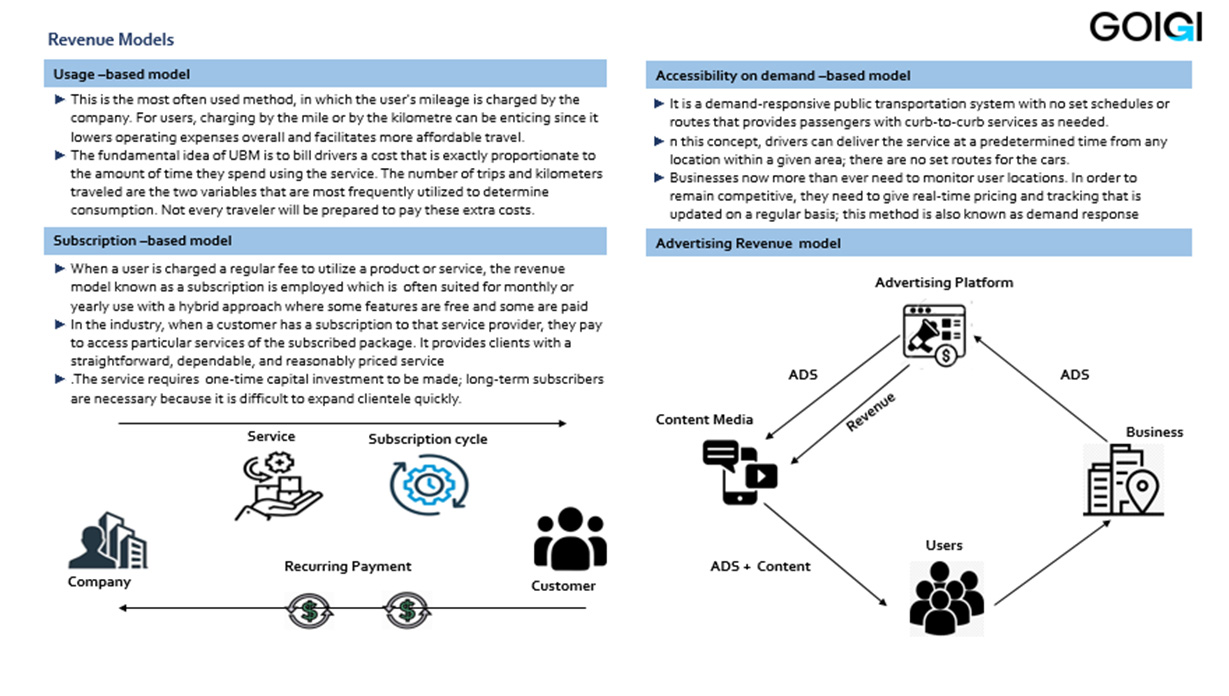

7. Revenue Models

8. Regional Insights- India

9. Regional Insights- India

10. Regional Insights- India

11. Regional Insights- India

12. Regional Insights- India

13. Company Profile- Agarwal Packers and Movers Ltd.

14. Company Profiling- Agarwal Packers and Movers Ltd.

15. Regional Insights- India

16. Cost Comparison- India

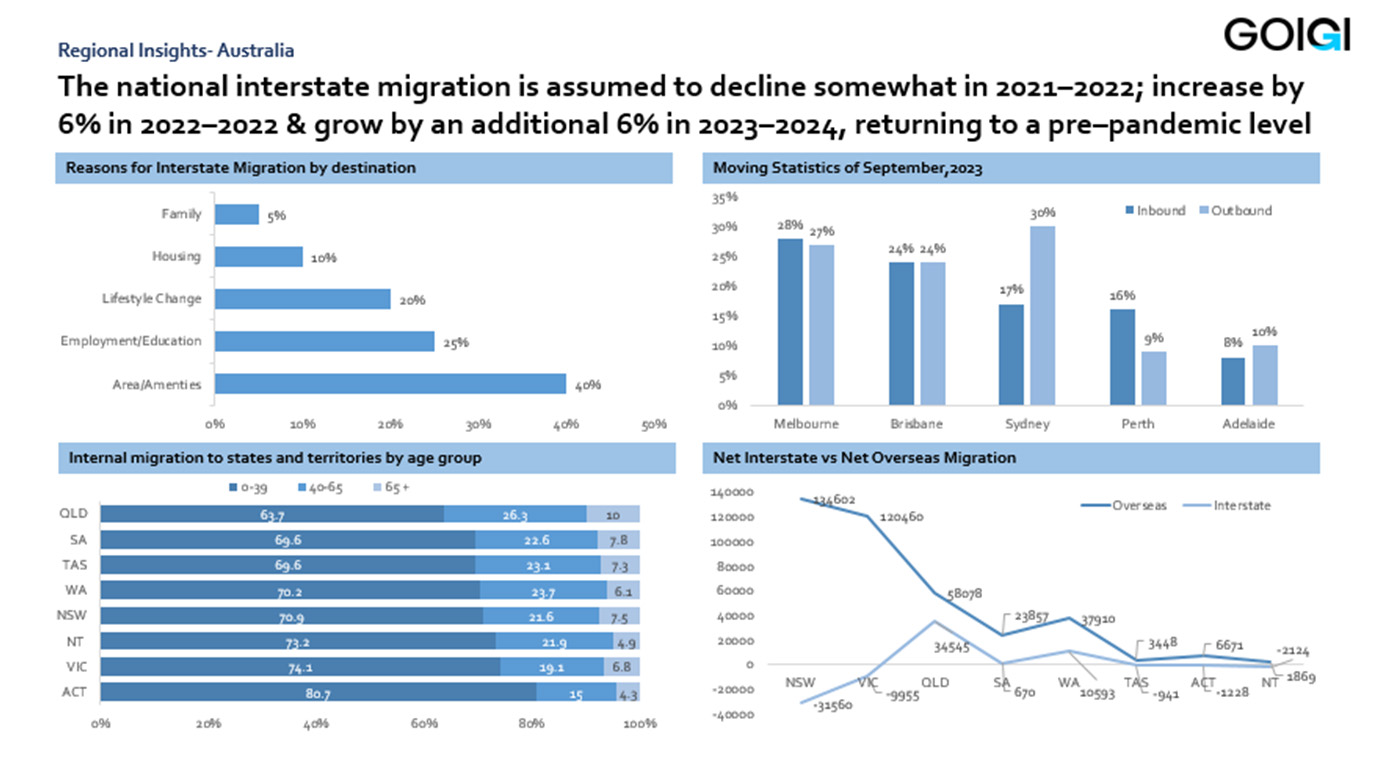

17. Regional Insights- Australia

18. Regional Insights- Australia

19. Regional Insights- Australia

20. Regional Insights- Australia

21. Regional Insights- USA

22. Regional Insights- USA

Download Entire report

Pay $4.99Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.

Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.

Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.