Download Entire report

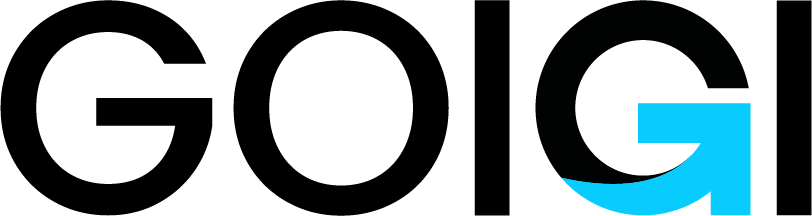

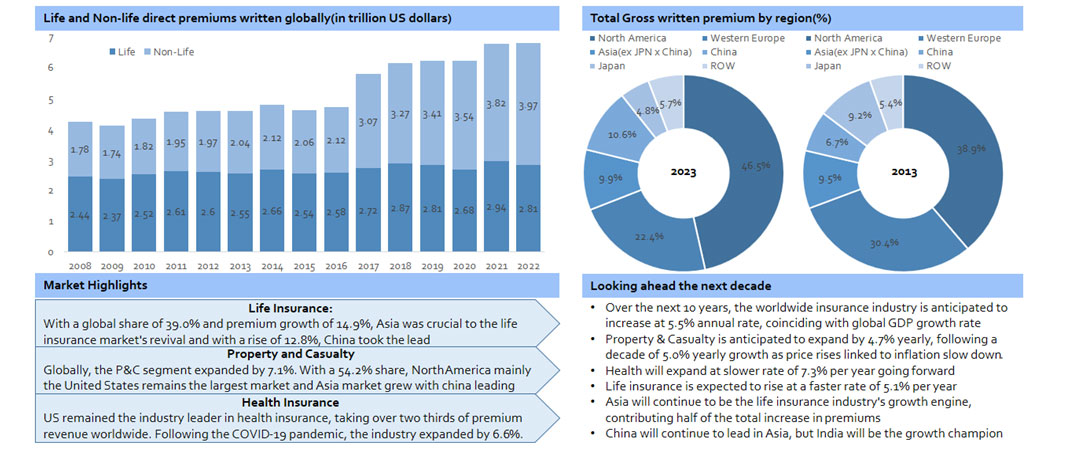

Pay $4.99The global insurance market was valued at $8.6 trillion in 2022 and is anticipated to grow at a CAGR of 1.97% in the forecast period (2022-2028) to reach nearly 10 trillion by 2028

Usage-based, on-demand, and "all-in-one" insurance lifestyle solutions will become increasingly relevant in the digital economy; consumers will favor customized insurance policies over the existing one-size-fits-all offerings; flexible coverage is viable in the long run

The demand for insurance solutions covering ransomware attacks, data breaches, and other cyber incidents—with extended options to include business interruptions—is growing as cyber risks escalate

Implementing in place usage-and behavior-based pricing models and providing customized rates based on unique risk profiles for home, health, and vehicle insurance with dynamic policies to adjust coverage level & duration based needs

Using AI and machine learning to improve customer service (chatbots), fraud detection, predictive analytics, and targeted marketing creating internet portals and smartphone apps to facilitate customer support, submitting claims etc.

Creating goods and services to assist companies in adhering to new rules such as data protection laws and working with governments to create public-private alliances for social insurance and catastrophe risk management

Financial losses, reputational harm, legal ramifications, regulatory fines, and data breaches are all possible outcomes of cyberattacks and data breaches. Because hackers have the ability to steal critical data, there is a high stakes in preventing cyber dangers

Global insurance rates are at an all-time high; although certain life insurance businesses may take advantage of this for short-term financial benefits, in the long run, this raises borrowing costs and reduces long-term profit margins

As a percentage of income, costs have risen by 23% since 2003, but P&C insurers' prices have decreased significantly; these expenses will only rise in line with inflation, and rising premiums may lead to an increase in client recidivism in lean economic times

The existing regulatory obligations pertaining to climate change are likely to worsen, and insurers may have challenges in assessing and pricing climate-related risks, as well as greater claims payouts and increasing reinsurance costs

1. Industry Overview

2. Industry Market Size

3. Industry Outlook

4. Industry Trends

5. Pricing Insights

6. Consumer Insights

7. Opportunities & Challenges

8. Risk and Mitigation

9. Global Insurance Developments

10. Competitive Benchmarking

11. Company Analysis(1/3)

12. Company Analysis(2/3)

13. Company Analysis (3/3)

14. Regional Insights-USA

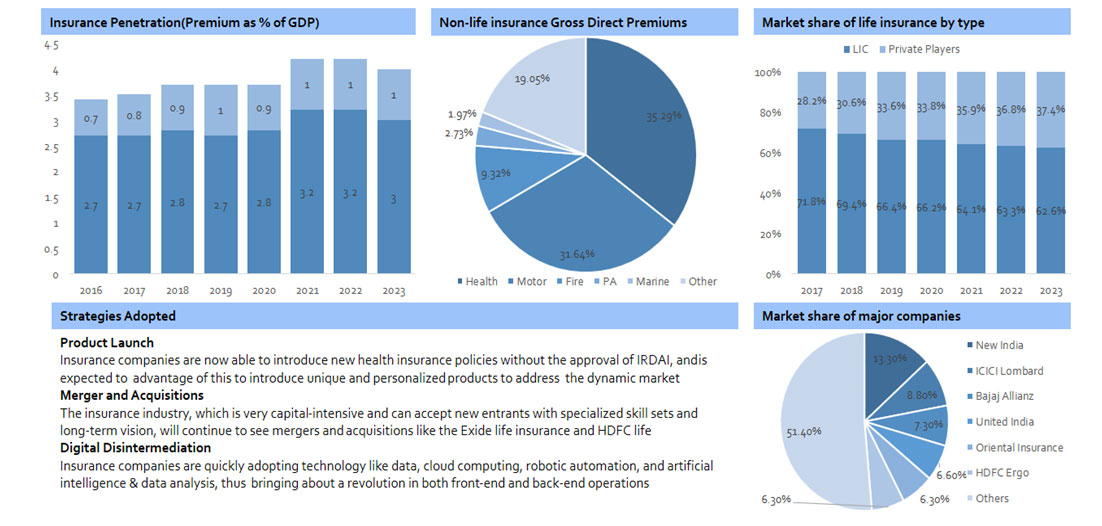

15. Regional Insights-India

16. Regional Insights-United Kingdom

17. PORTER’S Analysis

18. SWOT Analysis

Download Entire report

Pay $4.99Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.

Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.

Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.