Download Entire report

Pay $4.99The global IT services industry continues to be a highly fragmented one, with even the largest provider having a mid-single digit market share.

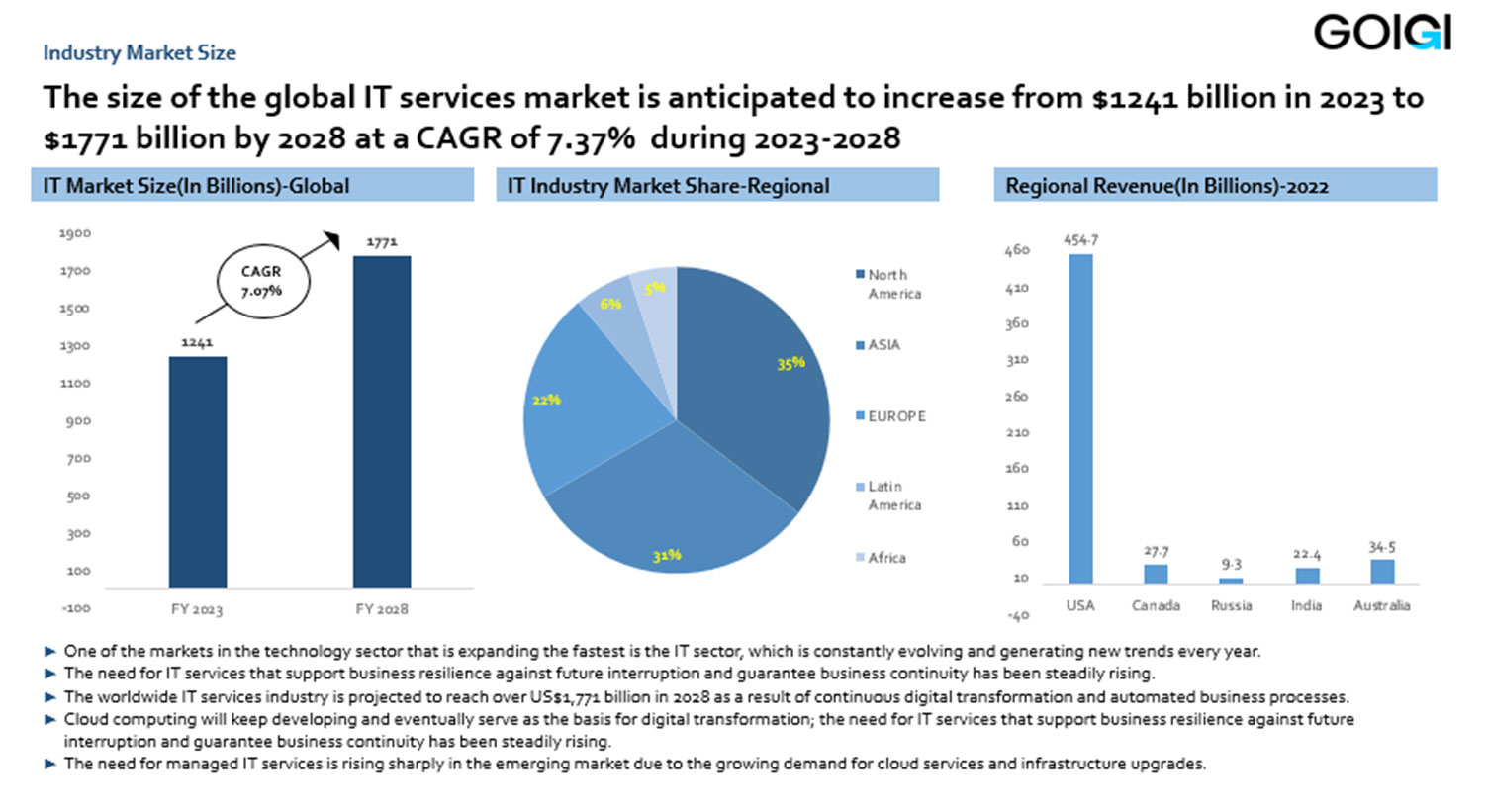

The size of the global IT services market is anticipated to increase from $1241 billion in 2023 to $1771 billion by 2028 at a CAGR of 7.37% during 2023-2028

Globally, rising IT investment, along with the industry's increasing use of cloud-based services and the broad adoption of software as a service, show how much demand there is for IT services.

IT services that are offered are probably going to be impacted by trends like 5G, Blockchain, AR, and AI; the next 5G technology will probably make it possible for businesses to install networks on their property.

The need for IT services is always expanding globally due to the growing acceptance of cloud-based software and the growing worry about automating company processes.

The market leader in 2022 was the reactive IT services category. Reactive IT services are in greater demand as a result of various factors, including the adoption of new technologies, software updates, and cybersecurity risks.

In 2022, the on-premises division had the highest revenue share. Higher levels of control and protection over data and apps are available with on-premises solutions.

Due to reasons such the increasing complexity of enterprise applications, the need for increased IT agility and efficiency, and the growing demand for mobile applications, the application management category retained the greatest market share in 2022.

Because cloud-based deployments are becoming more widely used, IT services will increase faster due to factors including improved scalability, lower IT expenses, and automated update availability. The need for cloud deployments has led to the adoption of cloud services by several verticals. Furthermore, compared to an on-premises setup, the data holding capacity is enormous. Despite employing traditional deployments, businesses are evolving to meet the needs of their clients.

Due to the rise of industrial automation, high-speed internet connections, and the growing ubiquity of mobile devices, data consumption has dramatically increased since 2017. The volume of data is increasing, which is presenting huge opportunities for IT service management. Similar to this, colocation data centers are in great demand due to the rise in data volumes. Businesses in this industry are depending more and more on IT services as a result of digitizing their operations and services.

Malware, phishing, viruses, and other forms of cybersecurity risks are examples of external IT risks brought on by criminal activity.

Among other things, technical failures include the malfunction of IT components such hardware malfunctions, software bugs, and coding errors.

1. Industry Overview

2. Industry Market Size

3. IT Industry Market Segmentation

4. Opportunities in the IT Industry

5. Risks and Mitigation Strategies

6. Trends in the IT Industry

7. Demand Drivers of the IT Industry

8. Price Analysis of the IT Industry

9. Recent Developments of the IT Industry

10. Competitive Landscape

11. Company Analysis

12. Company Analysis

13. SWOT Analysis of IT Industry

14. PORTER’S 5 Forces Analysis of IT Industry

15. Company Segmentation of IT Industry

Download Entire report

Pay $4.99Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.

Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.

Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.