Download Entire report

Pay $4.99E-commerce Logistics involves packaging, value-added services, transportation & warehousing;expansion of digital technology led to a rise in demand for e-commerce logistics

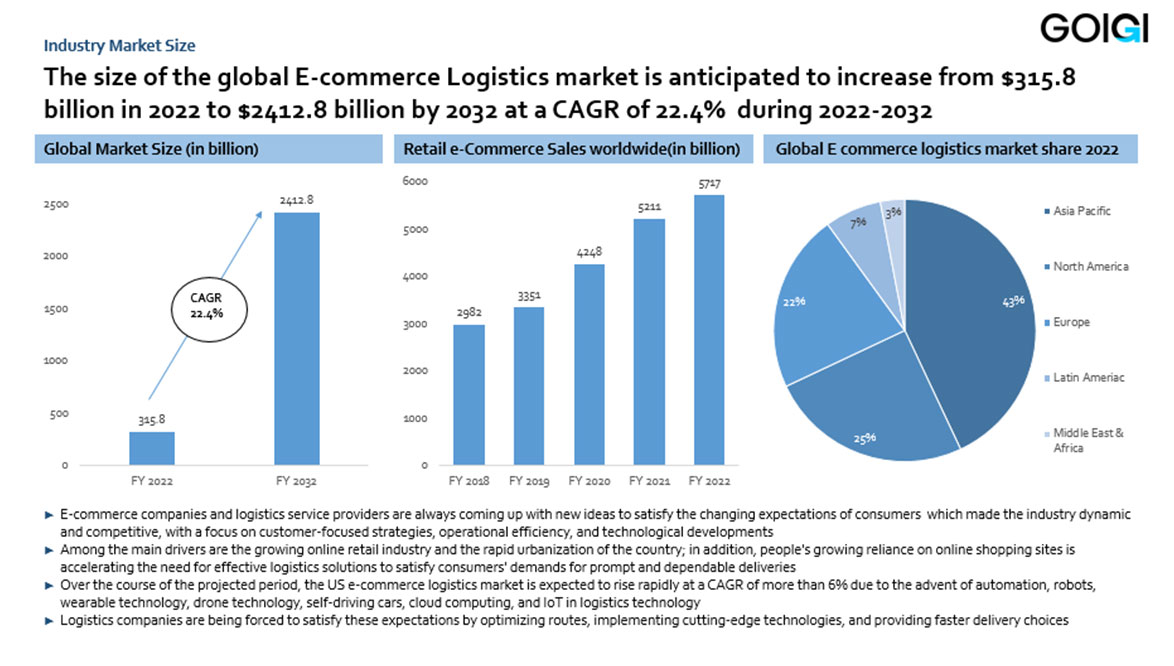

The size of the global E-commerce Logistics market is anticipated to increase from $315.8 billion in 2022 to $2412.8 billion by 2032 at a CAGR of 22.4% during 2022-2032

The pandemic had a beneficial effect on the e-commerce logistics market's expansion by enabling businesses to meet the extensive capacity demand of supply chain

Consumers desire to compare prices & product availability online encouraged them to make purchases of goods through online channels and hence need for e-commerce logistics services grew as a result with rapid growth in technology

It is projected that the market would grow considerably during the course of the forecast year due to factors including increasing smartphone penetration, drone delivery, digitization, and digital payments; expansion of the sector is also fuelled by the growing use of hardware technologies like GPS, portable data terminals, barcode technologies etc.

If the e-commerce firm be inventory-driven, then product supply may be disrupted by regional or worldwide events such as fires, floods, cyclones, or economic downturns

In the event of a typical surge in demand, there exists a possibility that the supply, which is determined by demand forecasts, may not be able to satisfy the additional demand and could lead to a decline in customer satisfaction and sales

Important consumer data, such as shipping addresses and contact details, is held by e-commerce businesses. It is necessary to safeguard this data from unauthorized access and misuse

Both consumer and vital business information are always at risk of being leaked; risks associated with third-party fraud include suppliers, sellers, and third-party logistics providers breaching agreements and engaging in actions that could damage a company's brand and reduce revenues

E-commerce is becoming more and more popular worldwide, which raises the need for effective logistical solutions. Strong logistics infrastructure is becoming more and more necessary as a result of the growth of online marketplaces and shopping platforms

Consumers increasingly expect faster and more reliable delivery services. E-commerce companies strive to meet these expectations, driving the need for advanced logistics systems that can handle quick order processing and timely deliveries

In most delivery processes, the "last mile" is the most costly and intricate. To solve this issue, e-commerce logistics companies are looking into cutting-edge last-mile delivery options including drones, driverless cars, and crowdsourced delivery schemes

Collaboration between the many supply chain participants—manufacturers, shipping companies, and retailers—is growing in frequency. This partnership expedites the entire logistical process, lowers expenses, and streamlines operations

1. Industry Overview

2. Industry Market Size

3. Workflow Structure- Conventional Vs E-Commerce

4. E-commerce Logistics Industry-Key Segments

5. E-commerce Logistics Industry- Value Chain Analysis

6. Risks and Mitigation Strategies

7. Trends in the E-commerce Logistics Industry

8. Demand Drivers

9. Recent Developments in the E-commerce Logistics Industry

10. Competitive Benchmarking

11. Fulfilment types-E commerce logistics

12. Logistics Industry-Segmentation

13. Market Size- 3PL

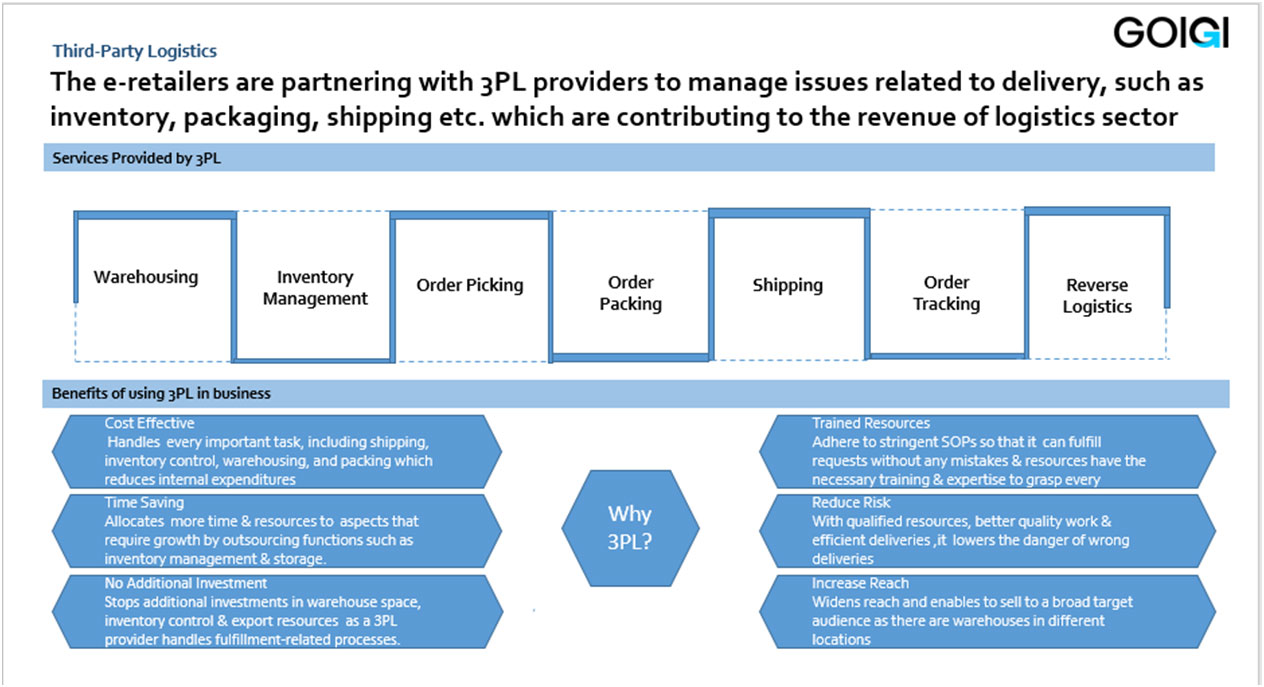

14. Third-Party Logistics

15. Overview - 4PL

16. Logistics Cost Comparison of Ecommerce Organizations

17. Comparison: In-House vs 3PL

18. Industry Insights- India(1/3)

19. Industry Insights- U.S.A (2/3)

20. Industry Insights(3/3)

21. Comparing 3PL vs 4 PL vs 5 PL

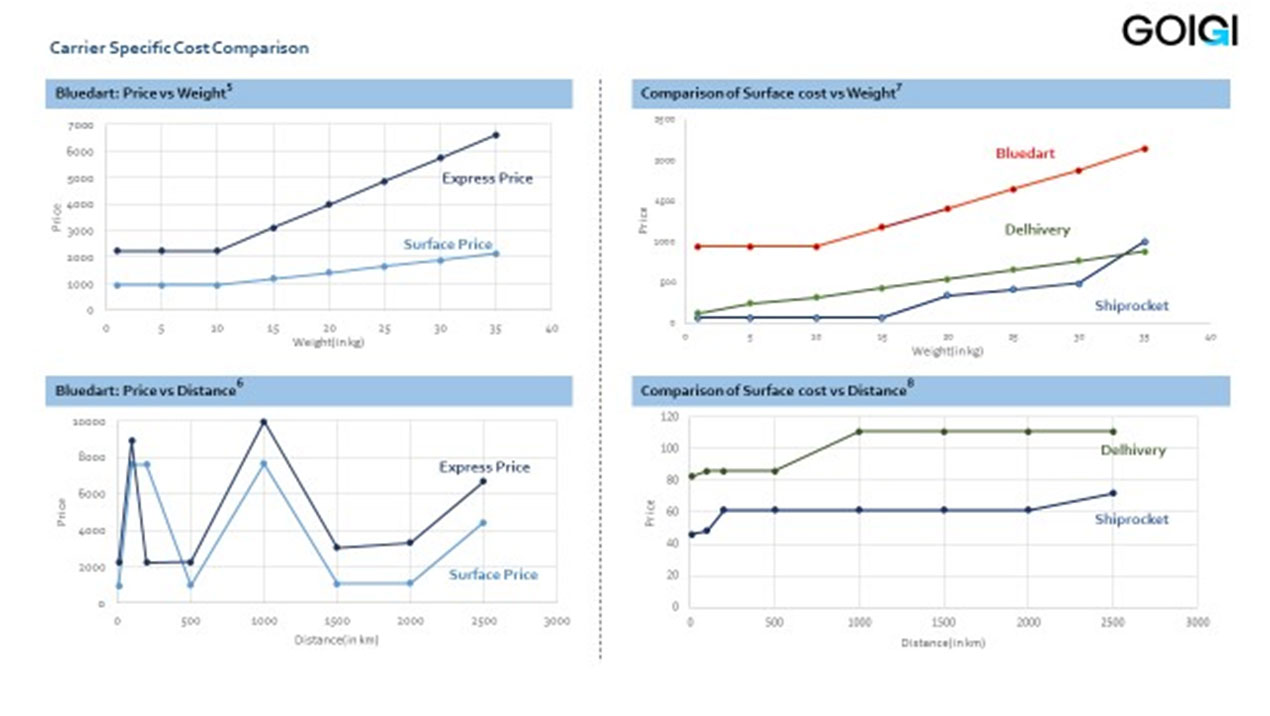

22. Carrier Specific Cost Comparison

23. Carrier Specific Cost Comparison

Download Entire report

Pay $4.99Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.

Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.

Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.